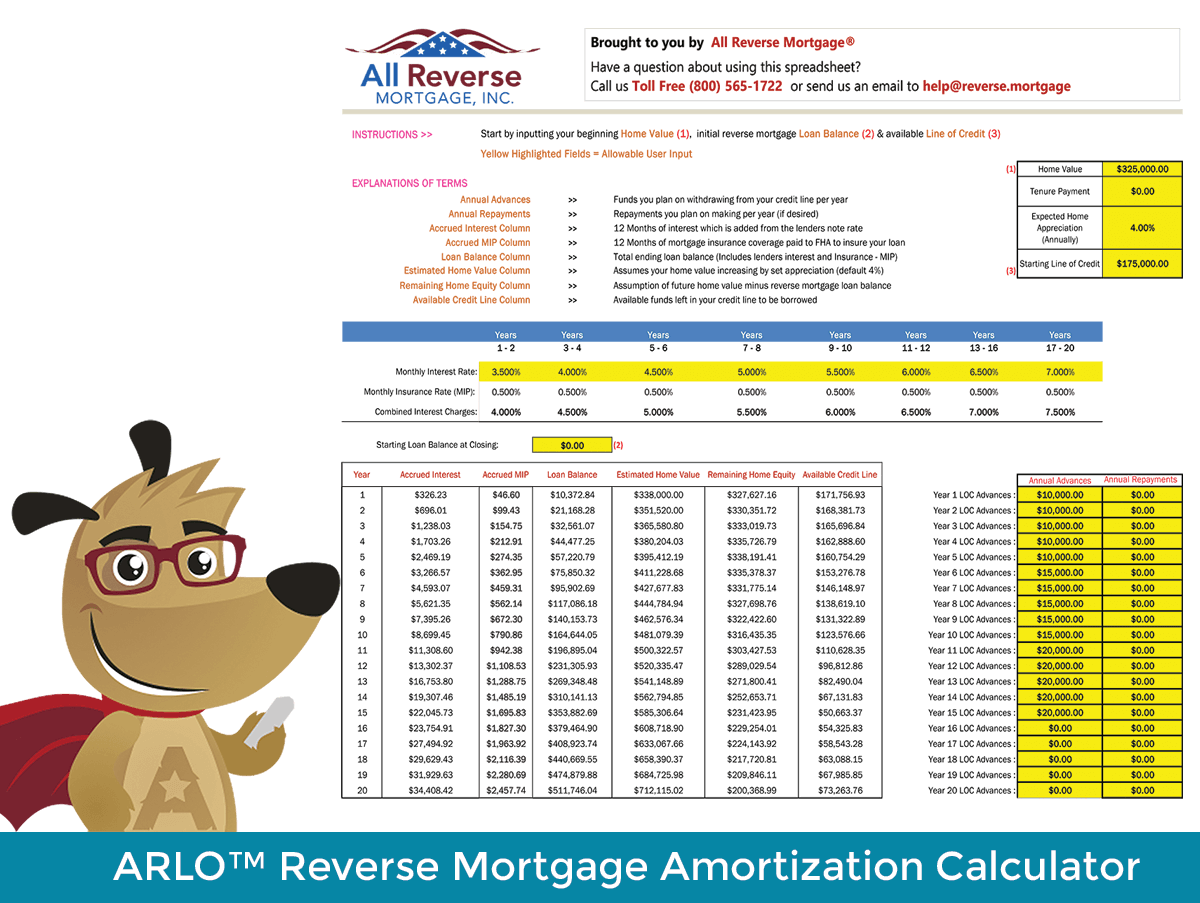

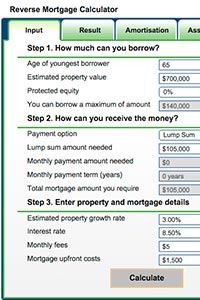

Note: You can use our free reverse mortgage calculator above to see what you may qualify for. Since a HECM is a non-recourse loan, when the loan matures and is due and payable, the FHA guarantees that neither the borrower nor their heirs will owe more than the home is worth at the time it is sold. The HECM loan balance usually becomes due and payable when the last surviving borrower permanently leaves the home. So long as the borrower lives in the home and pays the property-related taxes, insurance, and upkeep expenses, the borrower can continue to defer repayment of the loan balance. Available to homeowners age 62 and older, it allows the borrower to convert a portion of their home equity into cash or a growing line of credit and defer repayment of the loan balance until a later date. The most common reverse mortgage is a Home Equity Conversion Mortgage (HECM), the only reverse mortgage insured by the Federal Housing Administration (FHA).

(b) 80% of Appraised Property Value (capped at HK$25 million) (a) Sum of HK$8 million and 50% of portion exceeding HK$8 million, and Maximum Amount of Specified Property Value Specified Property Value means a figure in multiples of HK$10,000 which, by default, equals to the Appraised Property Value (or if the Appraised Property value exceeds HK$8 million, the relevant maximum amount of Specified Property Value as shown in the Table 1 below or, for the refinancing of an existing reverse mortgage loan, the relevant maximum amount of Specified Property Value as shown in Table 2 below), or any lower amount chosen or accepted by you.(b) the obligation to pay premium to the Hong Kong Housing Authority or the grantee of the Government Grant (as the case may be) before or upon disposal of the Property. (a) the obligation to resell the Property to the Hong Kong Housing Authority or its nominee pursuant to the Housing Ordinance or the grantee of the Government Grant pursuant to the Government Grant (as the case may be) and If the Property is a subsidised sale flat with unpaid premium under a Designated Housing Scheme, the Appraised Property Value is subject to the following restrictions being imposed on the Property owner, after taking into account of the applicable Discount Rate:

Appraised Property Value (a) means the value of the Property pursuant to the preliminary valuation conducted by the HKMCI and (b) if there is more than one Property mortgaged or to be mortgaged as security for a reverse mortgage loan, means the aggregate value of the Properties, subject to any adjustment the HKMCI may make at its sole discretion.

0 kommentar(er)

0 kommentar(er)